Essential Insurance Types 2025 – Coverage Guide, As we move forward in the US insurance market, knowing the key insurance types for 2025 is vital. This guide will give you a detailed look at health, life, property, and business insurance. It’s designed to help you understand your protection needs better.

Key Takeaways

- Explore the diverse range of insurance options available in the US market for 2025

- Understand the coverage levels and cost-sharing ratios of different health insurance metal tiers

- Learn about specialized insurance solutions tailored to different life stages and business needs

- Discover the importance of property and casualty insurance for safeguarding your assets

- Stay informed about the evolving trends and regulations shaping the insurance industry in 2025

Understanding Modern Insurance Coverage Landscape

The insurance world is always changing. It’s key to know the current landscape. This includes important terms, market trends, and how to choose the right coverage.

Key Insurance Terms and Definitions

The insurance world uses many terms that can be confusing. Here are some important ones to know:

- Beneficiary – the person or entity that gets the policy benefits

- Cash Value – the money you can get from a permanent life insurance policy

- Death Benefit – the money paid to the beneficiary when you die

- Permanent Life Insurance – life insurance that lasts your whole life

- Premium – the money you pay for insurance coverage

- Term Life Insurance – life insurance that lasts for a set time

Insurance Market Trends in 2025

The insurance industry is seeing big changes. These changes will shape the coverage landscape in 2025 and beyond. Some key trends include:

- More use of technology and data to make coverage better and more personal

- More specialty insurance products, like cyber insurance and coverage for gig workers

- More embedded insurance, where coverage is part of other products and services

- More focus on making customers happy and improving online services

Coverage Selection Criteria

Choosing the right insurance involves several factors. These include:

- Age – younger people might focus on common illnesses, while older people need more coverage

- Health Status – people with health issues need different coverage

- Financial Situation – coverage should fit your budget

- Specific Needs – coverage should meet your unique needs

By understanding the modern insurance landscape, terms, trends, and selection criteria, you can make smart choices. This ensures you’re well-protected.

| Metric | 2023 | 2024 (Projected) | 2025 (Projected) |

|---|---|---|---|

| Global Non-Life Premium Growth (Real Terms) | 3.9% | 3.3% | 3.5% |

| Insurers’ Return on Equity | 9.5% | 10.0% | 10.7% |

| US Non-Life Sector Combined Ratio | 99.0% | 98.5% | 98.5% |

| Global AI-Related Insurance Premium Volume | $3.9 billion | $4.3 billion | $4.7 billion |

| Global Embedded Insurance Premium Volume | $550 billion | $624 billion | $722 billion |

Essential Insurance Types 2025: Comprehensive Overview

Understanding the key insurance types is vital for strong financial protection. As we move towards 2025, the insurance world will change a lot. Important policies will help protect people, families, and businesses.

Health insurance is a must-have, with plans in metal tiers like Bronze, Silver, Gold, and Platinum. Each offers different coverage and costs. There are also catastrophic plans for those who qualify. These plans help cover unexpected medical bills, making sure you get the care you need.

Life insurance is key for financial safety in 2025. You can choose from term, whole, universal, and variable life insurance. These options meet different needs and budgets. Term life insurance is getting popular for its low cost and flexibility.

- Term life insurance policies: 10-year, 20-year, and 30-year coverage options

- Whole life insurance: Highly-rated insurers offer policies with 5.0 and 4.5 NerdWallet ratings

- Universal life insurance: Provides adaptable coverage and investment opportunities

- Variable life insurance: Allows policyholders to invest a portion of their premiums

- Burial insurance: Offers coverage for final expenses, with issue ages ranging from 45 to 80 and death benefits from $5,000 to $25,000

Property and casualty insurance, like homeowners and auto, protects your most valuable things. It covers many risks, from natural disasters to accidents. This ensures your financial safety when unexpected things happen.

Specialized insurance options are also becoming more common. They cater to different life stages and unique needs. These policies offer specific coverage for various situations and needs.

As the insurance world keeps changing, knowing about these essential types is crucial. It helps people and businesses make smart choices. This way, they can stay protected and financially strong in the future.

Health Insurance Plans and Marketplace Options

Finding the right health insurance can be tough. It’s important to know about the different plans and what they cover. This way, you can choose one that fits your health needs and budget.

Metal Tier Coverage Levels Explained

Health insurance plans come in four metal tiers: Bronze, Silver, Gold, and Platinum. Each tier shows how much of your healthcare costs the plan will cover. Bronze plans cover 60%, while Platinum plans cover 90%. Silver plans cover 70% and might offer extra savings.

Premium vs Out-of-Pocket Costs

Monthly premiums are a big part of health insurance costs. But, it’s also key to think about what you’ll pay out-of-pocket. Plans with higher premiums might have lower out-of-pocket costs. On the other hand, plans with lower premiums might cost more when you get medical care.

Special Enrollment Considerations

The main time to buy health insurance is during the open enrollment period, from November 1st to January 15th. But, there are special times to enroll if you have big life changes. These include losing your job, getting married, or having a baby. Using these times can help you keep your coverage and get the care you need.

| Plan Type | Plan Share | Premium Contribution | Out-of-Pocket Costs |

|---|---|---|---|

| Bronze | 60% | Lower | Higher |

| Silver | 70% | Moderate | Moderate |

| Gold | 80% | Higher | Lower |

| Platinum | 90% | Highest | Lowest |

Understanding health insurance plans and Marketplace options is key. It helps you find a plan that meets your needs and budget. Remember, enrolling at the right time and knowing about special enrollment periods is crucial. This ensures you get the healthcare protection you need.

Life Insurance Policies and Protection Options

In 2025, life insurance is key for financial planning. Americans have many options to protect their families and secure their finances. These include term life and whole life insurance.

Term life insurance is popular for its low cost and big death benefit. It lasts from 10 to 30 years. If you outlive the term, you can get a new policy or convert it.

Whole life insurance offers lifelong coverage and grows a tax-deferred cash value. It’s flexible and can adjust to your changing needs and budget. This makes it a solid choice for long-term financial security.

Universal life insurance combines term life’s flexibility with cash value growth. It comes in different types, each with its own features and risks. This lets you choose what fits your needs best.

| Insurance Type | Key Features | Potential Benefits |

|---|---|---|

| Term Life Insurance | Coverage for a specified time period (10-30 years) | Affordable, large death benefit protection |

| Whole Life Insurance | Lifelong coverage, tax-deferred cash value growth | Financial protection, wealth building |

| Universal Life Insurance | Flexible premiums, investment-linked cash value | Customizable coverage, potential for growth |

When planning for the future, life insurance is more important than ever. With rising costs for care, a good life insurance policy is essential. It offers peace of mind and financial security for you and your family.

Property and Casualty Insurance Coverage

Property and casualty insurance is key to protecting your financial future. It includes homeowners insurance for your home and belongings. Auto insurance is also crucial, as it’s required in most states. Knowing about these insurance types helps you protect your assets well.

Homeowners Insurance Essentials

Homeowners insurance guards your most valuable asset – your home. It covers the structure, your belongings, liability, and extra living costs if needed. It offers a safety net against disasters and theft, helping you recover and rebuild.

Auto Insurance Requirements

Auto insurance is a must for driving, as it covers risks. It protects you financially if you cause injury or damage to others. You might also need coverage for personal injury, uninsured motorists, and damage to your vehicle, depending on your state.

Additional Property Protection Options

Homeowners and auto insurance are the basics. But, there are more options like flood, earthquake insurance, and umbrella policies. These add extra protection for specific risks, boosting your peace of mind and financial security.

| Insurance Type | 2023 Trends | 2024 Predictions |

|---|---|---|

| General Liability | +2% to +8% rate increases | +2.6% renewal rate increase in Q2 2024 |

| Auto Liability | +5% to +10%+ rate increases | +6.4% rate increase in Q2 2024 |

| Workers’ Compensation | -5% to +2% rate changes | 86% combined ratio, $18 billion reserve redundancy |

| Umbrella (High Hazard) | +10% to +20%+ rate increases | +20%+ rate increases for high hazard/challenged classes |

| Umbrella (Low/Moderate Hazard) | +8% to +15%+ rate increases | +8% to +15%+ rate increases for low/moderate hazard classes |

| Excess (High Hazard) | Not Available | +20%+ rate increases for high hazard/challenged classes |

| Excess (Low/Moderate Hazard) | Not Available | +8% to +12% rate increases for low/moderate hazard classes |

“Protecting your home and car is essential in today’s unpredictable world. Property and casualty insurance provides the security you need to safeguard your most valuable assets.”

Specialized Insurance Solutions for Different Life Stages

Insurance can seem overwhelming, but there are tailored options for each life stage. As we age, our insurance needs change. It’s vital to have the right coverage.

Young adults often look for affordable health and life insurance. These policies are crucial as they start careers and families. Many adults in the U.S. have medical debt, showing the need for good health coverage.

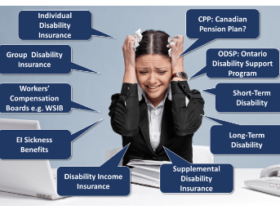

Middle-aged people might want disability income protection. This insurance helps protect their income. With many young adults facing long-term disabilities, this coverage is essential.

As we get older, long-term care insurance becomes key. The cost of assisted living is high, and this insurance can help. It’s especially useful for older adults and those with chronic illnesses.

Other specialized insurances, like travel, pet, and identity theft protection, are also important. They cater to specific needs at different life stages. With the right insurance, navigating life’s stages becomes easier and more secure.

| Life Stage | Specialized Insurance Solutions |

|---|---|

| Young Adults | Affordable health and life insurance |

| Middle-Aged | Disability income protection |

| Older Adults | Long-term care insurance |

| All Life Stages | Travel insurance, pet insurance, identity theft protection |

Understanding specialized insurance for each life stage helps build a solid insurance plan. It ensures the right coverage for unique needs and situations.

Business and Professional Insurance Coverage

As a business owner, keeping your company and employees safe is key. Good business insurance can protect you from many risks. This includes claims, property damage, and employee issues. Knowing about liability, employee benefits, and professional indemnity is vital for your business to grow and succeed.

Liability Protection Options

General liability insurance is a must-have for your business. It protects you from claims of injury, property damage, or advertising issues. Property insurance also helps by covering your assets like buildings, equipment, and inventory. Workers’ compensation insurance is often required by law to cover medical and lost wages for injured employees.

Employee Benefits Insurance

Offering great employee benefits can help you keep your best workers. Health, life, and disability insurance show you care about your team’s wellbeing. These benefits can boost morale, productivity, and loyalty.

Professional Indemnity Coverage

Professionals like consultants and IT experts need professional indemnity insurance. It protects against claims of negligence or mistakes. Cyber liability insurance is also key in today’s digital world to guard against data breaches.

Finding the right business insurance can be tough. But with the right help, your company can stay safe and thrive in the long run.

| Insurance Type | Average Monthly Cost |

|---|---|

| General Liability | $42 |

| Commercial Property | $63 |

| Business Income | $85 |

| Professional Liability | $61 |

| Workers’ Compensation | $45 |

| Employment Practices Liability | $182 |

| Commercial Auto | $147 |

| Commercial Umbrella | $75 |

| Cyber Liability | $140 |

The cost of insurance can change based on your business’s specific needs. Talking to an insurance expert can help you find the best coverage for your company.

Conclusion

The essential insurance types for 2025 offer a wide range of coverage options. They help protect individuals, families, and businesses. Understanding the insurance landscape and making informed choices is key to financial security.

It’s important to regularly check if our insurance needs have changed. This is especially true during open enrollment periods. Changes in the market, like new Medicare plans and tech advancements, can affect our coverage.

By staying up-to-date and managing our insurance, we can protect ourselves. This way, we can face the future with confidence and financial stability.

FAQ

What are the essential insurance types to consider in 2025?

In 2025, you should think about health, life, property, and casualty insurance. Also, consider specialized insurance for different life stages and needs.

How are health insurance plans categorized in 2025?

Health insurance plans are sorted into metal tiers. These are Bronze (60% plan share), Silver (70% plan share), Gold (80% plan share), and Platinum (90% plan share). Silver plans might offer extra savings for some people.

What are the key life insurance policy options available?

Life insurance comes in several types. Term life covers you for a set time. Whole life insurance lasts your whole life and has a cash value part.

What does property and casualty insurance cover?

Property and casualty insurance protects your home and car. Homeowners insurance covers your home and belongings. Auto insurance is needed in most states. You can also get flood, earthquake, or umbrella policies for extra protection.

What specialized insurance solutions are available for different life stages?

There are insurance options for every stage of life. Young adults can find affordable health and life insurance. Middle-aged people might need disability income protection. Older adults should look into long-term care insurance. Other options include travel, pet, and identity theft insurance.

What types of business insurance solutions are available?

Businesses have many insurance options. These include general liability, property, workers’ compensation, and employee benefits insurance. There’s also professional indemnity and cyber liability insurance to cover various risks.

Leave a Reply

View Comments